Grants, Loans and Jobs

Lorem Ipsum

Grant Renewal Policy

The financial aid amount should not exceed the cost of any credit left for both undergraduate and graduate students during their last semester(s) at AUI (such as the one credit left for continuous registration, or the three credits left for an internship). In case of one credit for continuous registration, this discount is applicable only once."

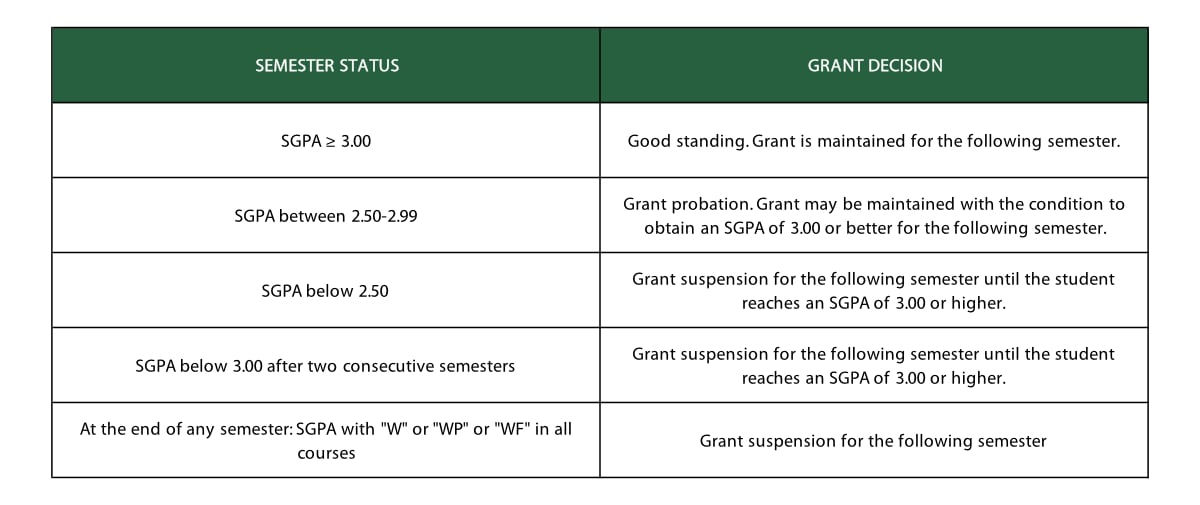

Graduate grant beneficiaries are eligible for an Al Akhawayn grant for a maximum of four enrolling semesters. To be eligible for aid and to retain eligibility, a student must be making satisfactory academic progress by achieving a minimum semester grade point average (SGPA) of 3.00/4.00 at the end of each semester. Graduate students who fail to meet this requirement during the fall or spring semester are placed on financial aid probation for the following semester. If they are unable to achieve satisfactory academic standing at the conclusion of the probationary semester, they are placed on "financial aid suspension" until such time that they satisfy the semester grade point average requirement. If, on the other hand, students obtain a semester grade point average below 2.50/4.00, they lose their eligibility to receive financial aid for the following semester. Moreover, If the student obtains "W" "WP" or "WF" in all courses at the end of any semester, s/he will be automatically placed on grant suspension for the following semester. The summer session GPA will not be taken into account either for probation, suspension, or reinstatement.

The following table summarizes the data above:

A separate financial aid system is also applicable to graduate students with Al Akhawayn grants enrolled in Language Center courses, level 2, with or without foundation courses in their first or second semester at Al Akhawayn.

- Graduate students can use their scholarship and/or financial aid when combining any of the following categories:

- Language Center level 2

- Online Foundation courses

- Face-to-face Foundation courses

- Regular courses.

SSAHRA program courses are not covered by the Financial aid.

-

Graduate students enrolled in Online Foundation courses only may benefit from either scholarship only or financial aid only under the condition of not exceeding the cost of the online foundation course (no combination of the two discounts). However, students benefiting from both discounts are eligible for scholarships only.

- Graduate students placed in Language Center level 1 and Foundation courses, can use their scholarship and or financial aid to cover the cost of foundation course(s) only under the condition of not exceeding the cost of the foundation course tuition.

- Graduate students placed at the Pre-Academic Language Center level are not eligible to use their scholarship or financial aid.

- Graduate students placed at the Language Center courses level 1, are not eligible to use their scholarship or financial aid.

- The financial aid renewal policy for graduate students taking language center courses, level 2, is based on "P" and "F" grades.

- Every failed or dropped language center course in level 2 will not be covered by either scholarship or financial aid for the following semester.

- The financial aid renewal policy for students taking foundation courses is based on "P" and "F" grades.

- Graduate financial aid beneficiaries obtaining a failing grade in a foundation course will be placed on financial aid probation for the following semester. If they are unable to regain satisfactory standing at the end of the probationary status, and if they are authorized to continue in the program, the student will be placed on continuous financial aid probation with financial aid suspension until such time as they satisfy the financial aid renewal requirements. If, on the other hand, a graduate financial aid beneficiary obtains two “F” (failing grades) in the foundation courses during the same semester, s/he will be automatically placed on financial aid suspension.

-

Graduate students still eligible for their financial aid or for a combination of their financial aid and scholarship and who are enrolled in very low credits during their last semester(s) can use their relevant package on a prorated basis.

-

SSE undergraduate students on financial aid enrolling in the Combined Program (BSMS) have the possibility to use and/or extend their financial aid towards their undergraduate courses only by converting their financial aid amount to a percentage based on a flat fee. That percentage will go towards the undergraduate credits' costs only as long as they take their undergraduate courses. Basically, these students were offered financial aid for their undergraduate program only for a maximum of 8 semesters while now they need additional semesters to complete the BSMS program requirements.

Loans

Bank Loans

Loan Term and Amount

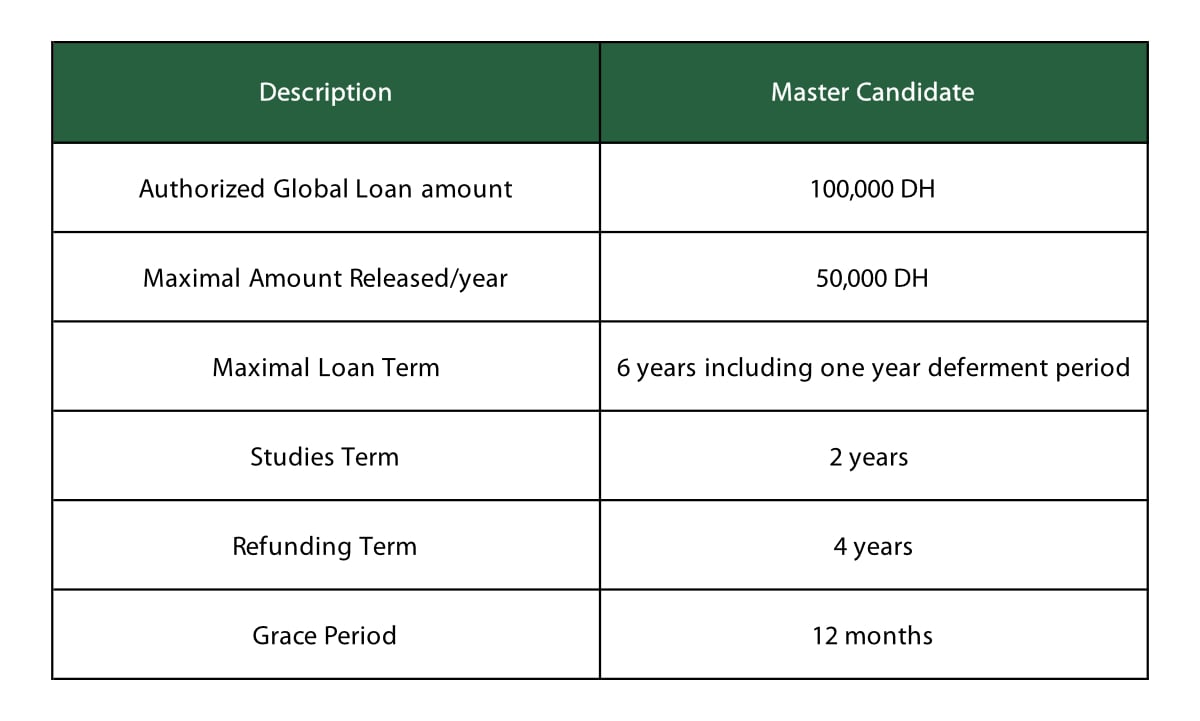

A bank loan is a form of financial aid that must be repaid. The loan recipient can benefit from a maximum of 50,000 MAD per year during two enrolling years. This loan program provides graduate students, even those with no financial need, with long-term loans payable over a reasonably long period with a 0% interest rate as the interests are supported by AUI. However, if ever the student falls in the 3rd year without being able to reimburse the global amount offered by the end of the 2nd year, the interest rate of 5.20% is applicable during the deferment and repayment period.

The term of this loan category is a maximum of 6 years consisting of two successive periods:

- The release phase of 2 years, corresponding to the duration of studies

- The loan reimbursement phase of 4 years, including the 12-month (1 year) payment deferment period.

A graduate student may apply for a bank loan at any semester; however, the final decision is subject to the bank's approval based on adequate supporting documentation.

For more details, please see the table below:

Applying for a Bank Loan

To apply for a bank loan, graduate students complete the Bank Loan Application Form, provide all the required documents, and submit them to the Financial Aid Office. The Financial Aid Office then makes a preliminary review for any missing documentation on the applicant's loan file and then transfers the file to the Bank Loan Committee for final review.

The bank loan process is very delicate and it takes significant time to go through all applications before taking any decision. Any missing document delays the smooth operation of the bank loan process.

Within the same framework, the Bank Loan Committee works in cooperation with the Financial Aid Office to satisfy parents' needs, but it is the primary responsibility of the bank to communicate the final decision to the loan applicant before the confirmation deposit period.

Any unused loan funds remaining in the student's account after withdrawal or completion of studies will be returned to the bank and not to the student or to the individual responsible for making the loan payment.

Qualified applicants will receive an award notification by mail and/or e-mail with information about the amount of the loan offered before their regular registration at Al Akhawayn. Students whose loan application files are rejected are also notified via mail and/or e-mail.

Student Employment

Student employment is an opportunity for a graduate student to work on campus and earn a specified amount of money per semester. This program also encourages community service work. Students must complete the Student Employment Application form to be considered for a work-study award.

Applying for Student Employment

Before the end of the semester, all enrolled Al Akhawayn graduate students have the possibility to apply for a part-time job for the subsequent semester by completing the Student Employment Application form and submitting it to the Financial Aid Office. The Financial Aid Office reviews the part-time job applications by checking eligibility for the work-study requirements. Then, the Financial Aid Office proceeds into the work-study assignment program.

Within the same context, some graduate students may be interviewed for job placement by their future supervisors. The Financial Aid Office also tries to take into consideration students' interests and abilities as well as the needs of the various university departments. Part-time job supervisors are not authorized to hire any student without a letter of appointment delivered by the Financial Aid Office.

Student Employment Eligibility

Student employment is available to the enrolled graduate students who have completed a minimum of 12 credits with a CGPA of 3.00 or better. Part-time job beneficiaries should also be aware that a part-time job is no longer automatically guaranteed from one semester to another. Rather, it is contingent upon a student's demonstrated financial need, work-study performance evaluation, vacancies available, and academic achievement.

Students are not allowed to benefit from two part-time job positions at the same time except with authorization from the Vice President for Academic Affairs. This program is not available during the summer session.

Student Employment Compensation

Once a part-time job beneficiary is assigned to a particular position, payment is credited to his/her account with the university at the end of the semester depending on the number of hours actually worked.

Part-time job beneficiaries are required to work a maximum of 10 hours a week (160 hours a semester) at the rate of 25 MAD an hour (4,000 MAD per semester). This number of hours may be exceeded to make up for missing hours in the case of absence, vacation, exam periods, and/or late assignments.

At the end of the semester, part-time job students left with a part-time job balance of more than 80 hours are placed on part-time job suspension for the subsequent semester.

Student Employment Assignment Areas

Graduate students meeting the eligibility requirements are assigned during the first week of classes to one of the positions offered in the following areas:

- Admissions Office

- Athletics Department

- Al Akhawayn School of Ifrane

- Financial Aid Office

- Housing Services

- Student Activities Office

- Department of Development and Communication

- Office of International Programs

- Office of Institutional Research and Effectiveness

- School of Business Administration

- School of Humanities and Social Sciences

- School of Science and Engineering

- Book Store