Grants, Loans and Jobs

Lorem Ipsum

Grants

A grant is offered to supplement a family's maximum financial effort. It is disbursed on a very limited basis and in a variety of amounts based on need and/or on academic merit. Only Moroccan students are eligible for financial aid.

A grant is a need-based aid that does not need to be repaid. It is awarded to both undergraduate and graduate students. Students must demonstrate financial need and provide parental data to be considered for these funds. The grant award is determined on the basis of parents' income and asset information the student provides to the Financial Aid Office as well as on his/her academic profile. It is awarded for a maximum of eight enrolling semesters. A grant is not available during summer sessions.

Grant Renewal Policy

Undergraduate grant beneficiaries are eligible for an Al Akhawayn grant for a maximum of eight semesters. To be eligible for aid and to retain eligibility, a student must be making satisfactory academic progress by achieving a minimum semester grade point average (SGPA) of 2.00/4.00 at the end of each semester. Undergraduate students who fail to meet this requirement during the fall or spring semester are placed on financial aid probation for the following semester. If they are unable to achieve satisfactory academic standing at the conclusion of the probationary semester, they will be placed on "financial aid suspension" until such time that they satisfy the semester grade point average requirement. If, on the other hand, students obtain a semester grade point average below 1.50/4.00, they will lose their eligibility to receive financial aid for the following semester. Moreover, If the student obtains "W" or "WP" or "F" or "WF" or a combination of these grades in all courses at the end of any semester, s/he will be automatically placed on grant suspension for the following semester. The summer session GPA will not be taken into account either for probation, suspension or reinstatement.

The following table summarizes the data above:

Financial Aid Regulations:

Continuing students on financial aid withdrawing from AUI will definitely lose their financial aid package if ever they decide to return to AUI.

Continuing students on financial aid suspended or dismissed from AUI for academic reasons will definitely lose their financial aid. However, if ever they are allowed to return back and register again, and then they obtain very good grades at least 2.00/4.00 or better based on at least 12 credits or 4 courses, they have the possibility to submit a financial aid appeal for reinstatement to the Financial Aid Office to be reviewed by the committee.

Continuing students on financial aid not enrolling at AUI after two successive semesters will definitely lose their financial aid package if ever, they decide to return to AUI. Otherwise, they need to reapply for new financial aid.

Continuing students on financial aid with serious health conditions may request a retroactive withdrawal from all courses taken during a given semester or term by filling out a “Retroactive Withdrawal Form” available at the DSA (Dean of Student Affairs) Office.

This petition must be accompanied by adequate documentation and bear all required administrative signatures mainly the physician’s confirmation of the student’s health conditions. Such cases with completed and approved retroactive forms should be reviewed by the financial aid committee to decide on the student's financial aid status for the following semester.

Financial aid recipients guilty of improper conduct or noncompliance with AUI regulations are under threat of grant suspension or cancellation.

Financial Aid Students with Language Center Courses:

A separate financial aid system is available for AUI grant students who are enrolled in Language Center courses (with or without FAS courses) in their first or second semester at AUI.

At the end of the semester, students who are left with a maximum of 4 language center courses (e.g. those passing from level 1 to level 2 and obtaining a minimum of “C” grade in their FAS and/or in regular courses), are eligible to maintain their grant for the following semester. However, if the undergraduate student obtains a failing grade of (D, F, or WF) in a Language Center course in either level 1 or 2 or in the FAS course, or in any "pass" and "fail" course, the virtual SGPA is highly considered in case of grant probation or suspension. The minimum SGPA to maintain the grant for the subsequent semester for undergraduate language center students is also 2.00/4.00 as stated in the table above.

NB: The financial aid policy stated above also applies to the sports scholarship or financial aid.

Withdrawal Policy for students on Financial Aid

A student withdrawing from the University in accordance with official procedures is eligible for a refund of tuition fees at the conclusion of the final clearance procedures.

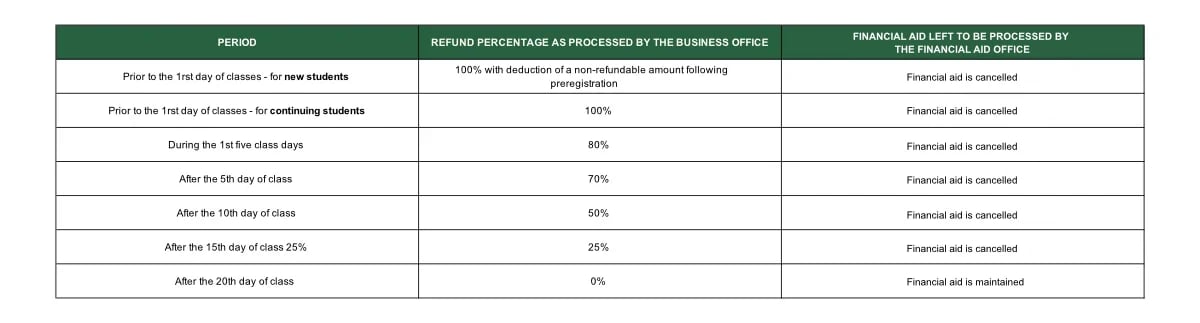

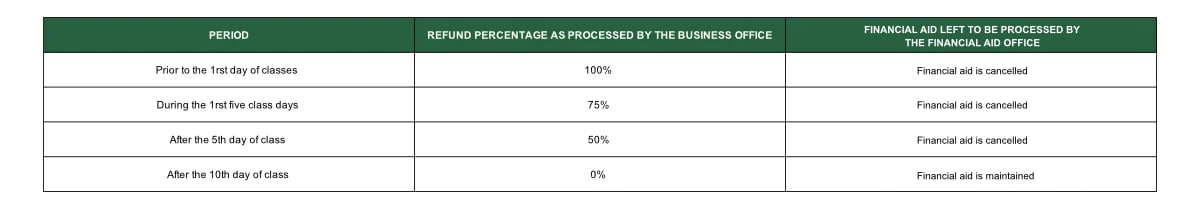

Tuition refunds are calculated according to the following schedule as defined by the Finance Department. Withdrawal policy for students on financial aid is used as follows:

- Financial aid can be maintained only if the student withdraws after the twentieth day of class for the fall and spring semesters.

- Financial aid is canceled when the student withdraws any time before the 21st day of class for the fall and spring semesters.

Refund Table for Fall/Spring Semester:

Refund Table for Fall/Spring Semester:

Loans

Bank Loans - Avenir Plus

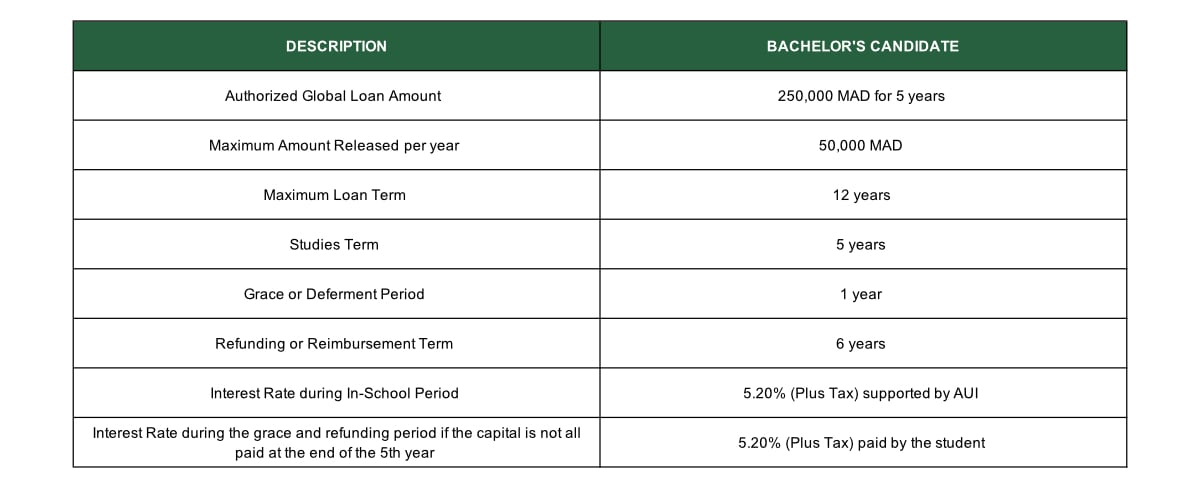

Loan Term and Amount

A bank loan is a form of financial aid that must be repaid. The student loan “Avenir Plus” has been created within the framework of cooperation concluded between the bank and the CCG “Caisse Centrale de Garantie” that will enable students to contribute substantially toward the financing of their own studies. The loan applicant can benefit from a maximum of 50,000 MAD per year during 5 enrolling years (250,000 MAD for 5 years). This loan program provides undergraduate students whose parents have limited income, even those with no financial aid, with long-term loans payable over a reasonably long period with an especially 0% interest rate as the interests are supported by AUI during the 5 enrolling years.

In the event of full reimbursement of the capital (maximum 250,000 MAD) before the end of the 5th Year, only the outstanding capital (maximum 250,000 MAD) must be reimbursed by the student to the bank, without having to pay any interest (0% interest). Beyond the end of the 5th year, the student can opt for a deferred additional one year (at an exceptional annual interest rate of 5.20%) to support the first year of job search i.e., the student could choose not to pay anything until the end of the 6th year.

This interest rate is the same rate applied to the in-school, grace, and repayment periods. Repayment is made in the form of equal monthly installments and starts 12 months after the last bank receipt released to the order of Al Akhawayn or after a student's withdrawal from the university.

An undergraduate student may apply for this bank loan at any semester; however, the final decision is always subject to AUI’s assessment of the student’s parents’ bank loan file as well as to the bank approval based on adequate supporting documentation.

The loan term is 12 years maximum, consisting of two successive periods:

- The release phase of 5 years, corresponding to the duration of studies, plus the 12-month (1 year) deferment period.

- The repayment phase of 6 years.

The interests from year 1 to year 5 are supported by AUI only for students who are offered the "Attestation d'Avis Favorable" by AUI.

For more details, please see the table below:

Applying for a Bank Loan

To apply for a bank loan, students should complete the Bank Loan Application Form, provide all the required documents, and submit them to the Financial Aid Office within the set deadline. The Financial Aid Office then makes a preliminary review for any missing documentation on the applicant's loan file and then transfers the file to the Bank Loan Committee for final review.

The bank loan process is very delicate and it takes significant time to go through all applications before taking any decision. Any missing document delays the smooth operation of the bank loan process.

Within the same framework, the Bank Loan Committee works in cooperation with the Financial Aid Office to satisfy parents' needs, but it is the primary responsibility of the bank to communicate the final decision to the loan applicant before the confirmation deposit period.

Any unused loan funds remaining in the student's account after withdrawal or completion of studies will be returned to the bank and not to the student or to the individual responsible for making the loan payment.

Qualified applicants will receive an award notification by mail and/or e-mail with information about the amount of the loan offered before their regular registration at Al Akhawayn. Students whose loan application files are rejected are also notified via mail and/or e-mail.

Student Employment

Student employment is an opportunity for an undergraduate student to work on campus and earn a specified amount of money per semester. This program also encourages community service work. Students must complete the Student Employment Application form to be considered for a work-study award.

Applying for Student Employment

Before the end of the semester, all enrolled Al Akhawayn undergraduate students have the possibility to apply for a part-time job for the subsequent semester by completing the online student employment application form before the set deadline. The Financial Aid Office reviews all the part-time job applications by checking eligibility for the work-study requirements. Then, the Financial Aid Office proceeds into the work-study assignment program.

Within the same context, some undergraduate students may be interviewed for job placement by their future supervisors. The Financial Aid Office also tries to take into consideration the student's interests and abilities as well as the needs of the various university departments. Part-time job supervisors are not authorized to hire any student without a letter of appointment delivered by the Financial Aid Office.

Student Employment Eligibility

Student employment is available to enrolled undergraduate students who have completed a minimum of 30 credits with a CGPA of 3.00 or better. The part-time job beneficiaries should also be aware that a part-time job is no longer automatically guaranteed from one semester to another. Rather, it is contingent upon a student's demonstrated financial need, work-study performance evaluation, vacancies available, and academic achievement.

Students are not allowed to benefit from two paid part-time job positions at the same time except with authorization from the Vice President for Academic Affairs. This program is not available during the summer session.

Student Employment Compensation

Once a part-time job beneficiary is assigned to a particular position, payment is credited to his/her accounts with the university at the end of the semester depending on the number of hours actually worked.

Part-time job beneficiaries are required to work a maximum of 10 hours per week (160 hours per semester) at the rate of 25 MAD per hour (4,000 MAD per semester). This number of hours may be exceeded to make up for missing hours in the case of absence, vacation, exam periods, and/or late assignments.

At the end of the semester, part-time job students left with a part-time job balance of more than 80 hours are placed on part-time job suspension for the subsequent semester.

Student Employment Assignment Areas

Undergraduate students meeting the eligibility requirements are assigned during the first week of classes to one of the positions offered in the following areas:

- Academic Support Office

- Admissions Office

- Athletics Department

- Book Store

- Department of Development and Communication

- Employability and Entrepreneurship Office

- Financial Aid Office

- Interfaith Office

- Information Technology Service (ITS)

- Library

- Office of Institutional Research and Effectiveness

- Office of International Programs

- Registration Office

- School of Business Administration

- School of Humanities and Social Science

- School of Science and Engineering

- University Honors Program